Title loans provide a fast and unique solution for individuals with bad credit needing immediate cash, offering title loan instant approval based on vehicle equity instead of credit history. The straightforward process involves verifying identity, reviewing vehicle details, determining loan amounts, and releasing funds within hours. Repayment requires understanding terms, making timely payments, responsible collateral management, maintaining communication, and preserving vehicle condition to avoid penalties and facilitate future financial decisions, including specialized financing like semi truck loans.

For individuals with bad credit, seeking a quick financial solution can be daunting. Enter title loans as a potential lifeline. This article explores how title loan instant approval offers a unique opportunity for borrowers facing credit challenges. We’ll break down the benefits of these loans and focus on the swift approval process, providing insights into what to expect. Additionally, we offer practical tips for navigating the repayment phase, ensuring a successful borrowing experience. Discover how this alternative financing option can provide much-needed relief during financial emergencies.

- Understanding Title Loans and Their Benefits for Bad Credit Borrowers

- The Instant Approval Process: How It Works and What to Expect

- Navigating the Repayment Process: Tips for Successful Borrowing

Understanding Title Loans and Their Benefits for Bad Credit Borrowers

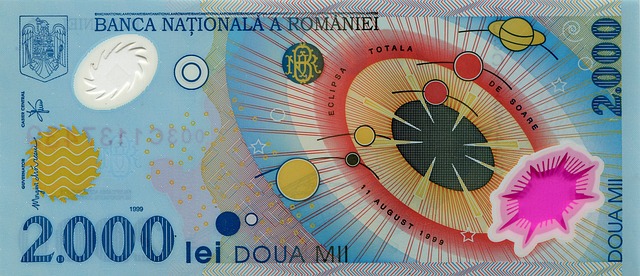

Title loans offer a unique opportunity for individuals with bad credit to gain access to immediate financial support. This alternative lending option involves using a vehicle’s title as collateral, providing borrowers with funds in exchange for temporary ownership of their car. The beauty of a title loan instant approval lies in its accessibility; it caters to those who may be rejected by traditional lenders due to their credit history.

For bad credit borrowers, this can be a game-changer as it provides a way to access cash quickly. The process is straightforward: borrow against the value of your vehicle, whether it’s a car or truck (in some cases, motorcycle titles are also accepted), and upon repayment, you regain full control. This form of lending is particularly appealing as it doesn’t require a lengthy application process or stringent credit checks, making it an attractive option for those in need of fast financial relief.

The Instant Approval Process: How It Works and What to Expect

The process of obtaining a title loan instant approval is designed to be swift and efficient, especially for borrowers with bad credit who may have limited options for traditional financing. This type of loan uses your vehicle’s equity as collateral, allowing lenders to assess your loan eligibility based on your vehicle’s value rather than your credit score. The whole procedure can be completed in a matter of hours, providing much-needed relief for those facing urgent financial needs.

When you apply for a title loan instant approval, the lender will first verify your identity and review your vehicle’s information to determine its market value. This includes checking the make, model, year, and overall condition of your vehicle. Once your loan eligibility is established, the lender will offer a loan amount based on the equity of your vehicle. You can then accept or decline the offer. If approved, the funds are typically released promptly, allowing borrowers to access the money they need quickly. This entire process streamlines borrowing, making it an attractive option for those in need of fast cash, including individuals seeking semi truck loans or other specialized financing.

Navigating the Repayment Process: Tips for Successful Borrowing

When you secure a title loan instant approval, understanding the repayment process is key to successful borrowing. Firstly, review your loan agreement carefully and ensure you grasp the terms, including interest rates, repayment schedule, and any penalties for late payments. Secondly, prioritize making timely repayments to avoid accruing additional fees.

To make this process smoother, consider using your vehicle collateral responsibly. Maintain regular communication with your lender about potential changes in your financial situation that might impact your ability to repay. Additionally, keep up with the required maintenance of your vehicle, as doing so can help you retain its value—a crucial factor in determining future loan options or when it comes time to pay off the title pawn.

Title loans offer a unique opportunity for individuals with bad credit to gain access to immediate funding through the instant approval process. By leveraging their vehicle’s equity, borrowers can secure a loan without the stringent requirements of traditional lenders. Understanding the benefits and navigating the repayment process diligently ensures a successful borrowing experience. Remember, responsible borrowing is key, and with proper planning, a title loan instant approval can provide a reliable financial solution.