Title loans offer immediate cash access with title loan instant approval, bypassing traditional credit checks and vehicle inspections. This digital process empowers individuals with less-than-perfect credit history to gain quick funds for emergencies or unexpected expenses. While convenient, these loans come with higher fees, shorter repayment windows, and repossession risk if not repaid on time, making it crucial for borrowers to thoroughly understand the conditions before securing a loan against their vehicle.

“Discover the convenience of a Title Loan Instant Approval – a fast and accessible financing option with no vehicle inspection required. This article demystifies this process, highlighting its benefits and unique features. Learn how it works, explore the advantages and potential drawbacks, and make an informed decision regarding this quick loan alternative. Understand the basics of title loans and unlock their potential to meet your immediate financial needs.”

- Understanding Title Loans and Their Benefits

- How Instant Approval Works Without Vehicle Inspection

- Pros, Cons, and Considerations for This Loan Option

Understanding Title Loans and Their Benefits

Title loans have emerged as a popular and convenient financial solution for individuals requiring quick access to cash. Unlike traditional loans that often involve extensive application processes and collateral, title loans offer instant approval with minimal requirements. This type of loan utilizes the equity in your vehicle’s title as security, allowing lenders to provide funds quickly without the need for a thorough vehicle inspection.

One of the key benefits of title loans is their accessibility. With no credit check required, individuals with less-than-perfect credit or limited credit history can still gain approval. Loan terms are typically structured to align with the borrower’s repayment capacity, offering flexibility and peace of mind. This alternative financing option has proven particularly valuable for those in need of emergency funds or facing unexpected expenses, providing a swift and efficient solution without the usual delays associated with traditional loan processes.

How Instant Approval Works Without Vehicle Inspection

With a title loan instant approval process, getting fast cash becomes a seamless experience, especially when you don’t have to worry about a vehicle inspection. This modern approach streamlines the traditional loan application method, allowing borrowers to secure financial assistance in a matter of minutes. The absence of an inspection doesn’t compromise the lending institution’s evaluation of your loan eligibility.

Instead, they rely on the power of digital documentation and online applications. Borrowers simply submit their vehicle’s title, along with relevant personal information, via an online platform. This digital transformation enables lenders to assess the value of the titled asset, verify identity, and process the application swiftly. By doing away with physical inspections, the entire process becomes more convenient, efficient, and accessible, ensuring a smooth journey towards securing fast cash.

Pros, Cons, and Considerations for This Loan Option

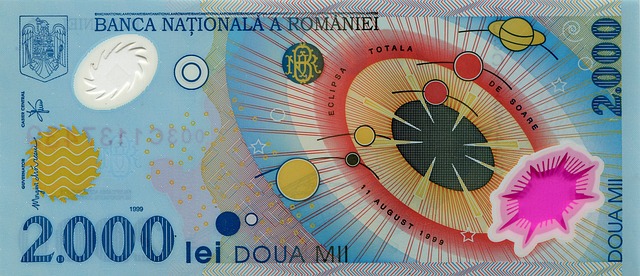

When considering a title loan instant approval with no vehicle inspection required, there are several factors to keep in mind. One of the primary advantages is the convenience it offers; applicants can secure funding quickly without the hassle of a traditional appraisal process. This is particularly beneficial for those in urgent need of cash, as it allows them to access their loan within hours. Additionally, since the loan is secured against the vehicle collateral, interest rates are often lower compared to other short-term financing options.

However, this lending option also has potential drawbacks. Lenders may charge higher fees and shorter repayment periods, which could lead to a cycle of debt if not managed properly. The lack of a thorough vehicle valuation by an expert might result in less favorable terms for borrowers. Furthermore, there is a risk of repossession if the borrower defaults on payments, as the lender has the right to seize the vehicle used as collateral. It’s crucial to weigh these considerations and ensure you understand all the conditions before agreeing to such a loan.

Title loans offering instant approval without vehicle inspection provide a convenient financing option for those in need of quick cash. While this process streamlines access to funds, it’s essential to weigh the pros and cons carefully. Pros include rapid funding and lenient requirements, but drawbacks may include higher interest rates and potential risks if unable to repay. Considering all factors, responsible borrowing and thorough understanding of terms are key when exploring a title loan instant approval option.